Joey’s right. What else could my furniture possibly be pointed at?

The front room. The lounge. Call it what you will, the majority of the people I know spend time in front of the box on an evening and a weekend.

In the digital marketing world, you could argue that we’ve been discouraging investment in traditional TV media buying in favour of digital channels – search, display, content marketing, paid social. eMarketer predicts that by 2020 online ads will account for 60% of marketing budgets while TV will represent just 21.5% – a decline from the projected 25% slice anticipated this year. The cases for doing so usually revolve around “better attribution” or “millenials don’t watch TV” perhaps with a chart similar to the below (click to expand).

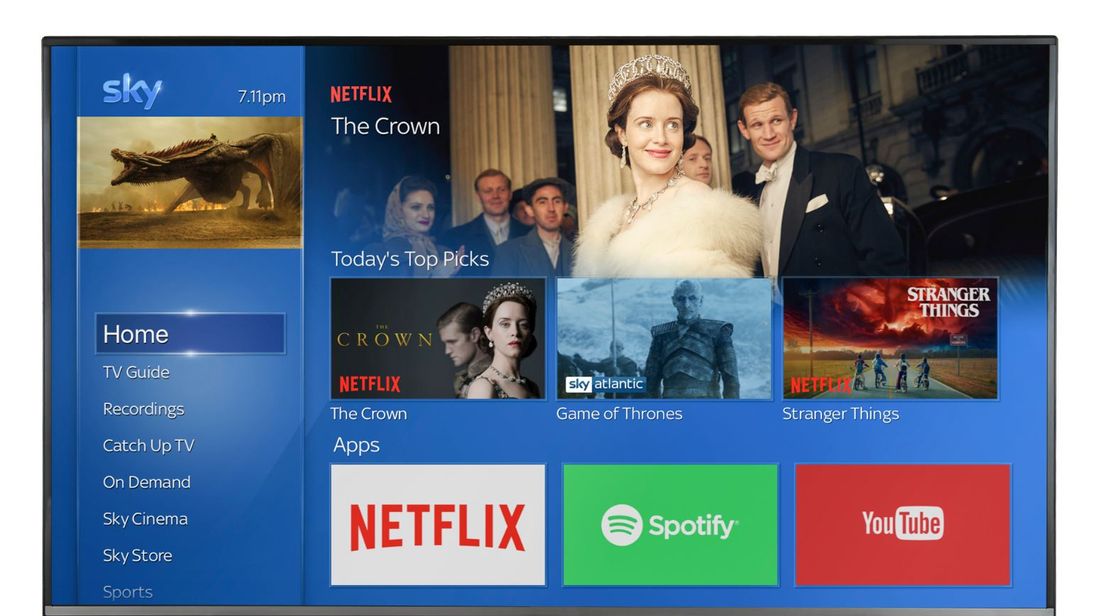

Those sweeping statements aren’t strictly true. There’s a reason why ‘as seen on TV’ remains a signal of more trust than ‘as seen on Facebook’. As recent news showed (the deal between Netflix and Sky) the relationship between traditional TV and streaming/ subscription services is increasingly blurred.

Below we breakdown some of the stats of the TV media buying universe, into four key areas;

- State of the nation – general overview

- How people watch ads and how much they cost

- The effectiveness of TV advertising

- Subscription Video on Demand (SVOD; Netflix etc)

State of the nation

- According to the Independent, the average Briton spends almost 10 years of their life watching TV, putting that into context Barb think that people spend an average of 3 hours 23 minutes watching TV each day.

- In the UK there are several different TV platforms, the dominant platform is Freeview terrestrial TV and that has 50 SD channels and 10 HD channels. Freesat has 142 TV channels of which 11 are HD. For Pay TV the dominant player is Sky TV which has around 600 TV channels but these depend on the package you are on. Via Quora

- There are c. 59,000,000 adults in the UK TV viewing universe according to BARB

- People spend an average of 3 hours 23 minutes watching TV each day according to BARB

- On top of that, people spend a further 76 minutes including other types of video including SVOD (eg Netflix), cinema and YouTube via Thinkbox.

- In the UK we watch around 180m hours a day of TV according to The Guardian

- TV accounts for 40% of the average adults’ chosen media day, and 28% of the media day for 16-24 year olds, according to Thinkbox

- Although Millennials watch less TV (16-24 year olds watch an average of 1.61 hours a day), they watch more TV as they grow up (25-34 year olds watch an average of 2.23 hours a day) and have kids (25-34 year olds with kids watch an average of 2.68 hours a day) according to Thinkbox

- People see an average of 43 TV ads a day via Thinkbox

- 80% of everything we view is live – it’s still the most popular way the UK watches TV according to TV Licensing.

- And even in houses with TV recorders, only 10% fast forward through all TV ads, meaning 90% see at least 1 ad a week. Via Thinkbox

- 74% of adults dual screen weekly according to Thinkbox

- The average adult spends 41 minutes a day using the internet whilst watching TV according to the IPA

How people watch ads and how much they cost

- During ad breaks, 57% of dual-screeners agree with the statement “I just stayed where I was and waited for the programme to restart” compared to 49% of people not dual-screening according to Thinkbox

- 99% of people consume some sort of TV or video each week according to the IPA

- 62% of people say that tv is the most likely place to find advertising that makes you laugh which is more than with any other channel via Thinkbox

- 58% of people say that TV is the most likely place to find advertising that evokes emotion which is more than with any other channel via Thinkbox

- 54% of people say that TV is the most likely place to find advertising that is most liked which is more than with any other channel via Thinkbox

- 42% of people say that TV is the place you are most likely to find advertising that you trust which is more than with any other channel via Thinkbox

- A 30-second ad during ITV’s breakfast schedule between the likes of Good Morning Britain or Lorraine costs between £3,000 to £4,000 on average. For a daytime slot, ads of the same time length come in at £3,500 to £4,500, while a peak rate alternative can cost anything from £10,000 – £30,000. According to The Drum.

- On average Channel 4 is cheaper than ITV. A 30-second slot on daytime TV can cost between £1,000 to £2,000. Peak rates during shows like Hollyoaks or Catastrophe clock in at £10,000 to £20,000. According to The Drum.

- A TV commercial can cost from as little as £10,000 to produce via Spacecity

- Online businesses are the biggest investors in TV according to EGTA.com, contributing almost £700m of overall investment in the UK.

The effectiveness of TV advertising

- TV creates 62% of short term profit at the highest efficiency via Thinkbox

- TV delivers 71% of advertising-generated profit via Thinkbox

- Including TV in your media plan drive effectiveness (in terms of the increase in the average number of very large business effects) by 29% via Thinkbox

- In the short to medium term, advertising drives 39% of sales, of which TV drives 33% according to Thinkbox

- TV drives a response through several channels directly. It generates 25% of all media-driven sales delivered via the phone, 45% of all media-driven sales via bricks & mortar and 29% of media-driven sales through web traffic driven direct-to-site – this includes non-paid-for search. According to Thinkbox

- In addition, TV drives an indirect response through online channels, generating 33% of media-driven sales via paid-for online search; 26% of media-driven sales whose last click is via an online display ad and a fifth of media-driven sales via affiliate marketing, says Thinkbox.

- TV is responsible for driving 33% of all media driven interactions for brands on Facebook, according to Thinkbox

- In a Google study of 98 different TV campaigns, every campaign saw a lift in product discovery after its TV ad aired. Three out of four of those queries involved people searching directly for the advertiser’s brand. According to Think with Google.

- Channel 4 is the top converting commercial terrestrial channel for both 16-34s and ABC1 Adults via 4Sales.

- All 4 is the no. 1 reaching video on demand platform for young audiences, reaching 34.4% of 16-24’s, and 31.1% of 16-34’s according to 4Sales

- 4Music & the Box channels reach 22% of 16-34s every month (3.2m) via 4Sales.

- ITV is the biggest digital channel for 16-34s: ITV has overtaken E4 to be the biggest channel for 16-34 viewing, with a 5.5% share. Via ITV Media.

Subscription Video on Demand (SVOD; Netflix etc)

- The SVOD (Subscription Video on Demand) market is enjoying a sustained period of growth in the UK; in 2017 there were more than nine million UK households subscribe to at least one SVOD service. Via BARB.

- Netflix is watched by 29% of adults and 54% of 15–34 year olds, each week according to IPA

- Subscriptions to SVOD services are not exclusive however, and the number of households that are subscribing to more than one service is increasing. By the third quarter of 2017, of the 7.5 million households subscribing to Netflix, 2.3 million also subscribed to Amazon Prime Video – 31% of Netflix’s subscriber base. Likewise, of all Amazon Prime Video subscribers, a significant 60% of them also subscribed to Netflix. According to BARB.

- Nearly 50% of all children in the UK have access to one of the SVOD services. For young adults aged 16-24, nearly 60% have access to one of the SVOD services. According to BARB.

- 40 million of us now watch episodes back-to-back Via Ofcom

- Eight in ten adults in the UK (79%) – or 40 million people – use catch-up technology such as BBC iPlayer, or subscription services such as Netflix, to watch multiple episodes of a series in one sitting, wiping out the wait for next week’s installment. One third (35%) do so every week, and more than half (55%) do it monthly. Via Ofcom

- Nine in ten people watch live TV every week, and family viewing is still an integral part of family life. Three in ten (30%) adults say their family still watches the same programmes or films together every day, while 70% do so at least once a week. Nearly seven in ten (68%) say watching TV can bring the whole family together for a shared viewing experience. Via Ofcom